Tips for Boosting Your Credit Score for Personal Loan (Forbrukslån)

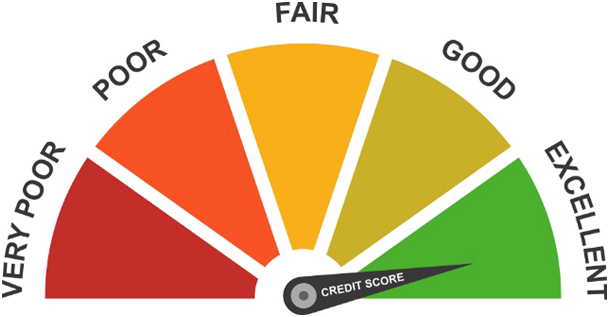

One of the most important measures of your financial health is a credit score. It indicates lenders will use it to determine whether you can repay the amount they give you.

The better your score, the chances are higher they will approve you and offer you the best terms possible. Keep in mind that a high score will allow you to get the lowest interest rates.

By checking here, you will understand the importance of visiting AFSA to learn more about loans and lending institutions.

Improving a score is not as simple because you must be patient, especially if you have reached a bad rating. Still, you should implement a few things or habits that will help you determine the best course of action.

The Importance of Good Credit Score

An excellent or good credit score will help you save hundreds of thousands of dollars. Having perfect rating will allow you to get the best rates for car loans, mortgages, and other financing products such as personal loans.

Therefore, individuals with excellent ratings are low-risk borrowers, meaning banks are more likely to offer them better fees, rates, and other rewards. On the other hand, people with lousy ratings are high-risk borrowers, meaning few lenders will compete with them. More businesses will get away from them in the short run.

Suppose they approve you with a low score. In that case, you will get a significant APR or annual percentage rate. At the same time, you will have fewer chances of finding a vehicle, rental housing, and life insurance.

Analyze Credit Reports

The best way to improve score is by understanding what works for and against you. Therefore, you should check your history to determine the best course of action. We recommend you check out your report from TransUnion, Experian, or Equifax, which are three major national bureaus.

You can do it once a year through online means, which will not reduce the score, but offer you insights into income, debts, and other actors. Remember that the most critical factors for building your score include the history of on-time payments, low balance, older accounts you paid on time, and minimal inquiries for new loans.

On the other hand, high credit card balances, missed payments, judgments, and collections will reduce and affect your score in the worst way possible. You should check out the rating regularly to ensure you deal with potential errors. Still, it is vital to conduct a soft inquiry, which will not reduce the rating after each pull.

You should check out the rating and determine the reasons why it is low. Numerous banks will offer you free monitoring, which will alert or notify you as soon as the rating changes. For instance, we recommend you pay revolving debt as soon as possible to reduce the utilization process.

Besides, late payments are the worst for rating, so you should pay everything on time.

Handle Bill Payments

You should know that most lenders will take advantage of FICO credit scores, which depend on five essential factors: payment history, credit mix, age of accounts, credit usage, and new inquiries.

You can probably understand that the payment history will make the most significant impact on your score. Therefore, you should pay debts, including old student loans, to ensure they do not get on your record. The main goal is to be as responsible as possible for debt, which will work in your favor.

Therefore, the simplest way to boost your score is to avoid being late on payments by following these tips:

- Create a digital or paper filing system that will keep track of monthly bills with ease

- Pre-set due date notifications or alerts to remember when the next one is coming

- Automate bill payments, which will provide you peace of mind directly from a banking account

You can also charge all your monthly bill payments using a credit card. However, you should pay the balance entirely without entering a point of high interest. Although you can simplify the payment process, dealing with credit card interest rates can affect your future and thus the score you wish to maintain or improve.

Credit Utilization Should Be 30% or Less

After repayment history, the second most important factor in FICO score is credit utilization. The utilization is a portion of the limit you use at a particular time. The simplest way to keep it in check is to pay credit card balances every month.

Suppose you cannot do it. You can only work by reducing it to ten percent or less, which is the ideal setting for boosting your credit score. Then the rule of thumb is to keep the overall outstanding balance below thirty percent to ensure proper credit limitation.

We recommend you to check out this website: https://www.forbrukslånbilligst.com/ to learn about personal loans.

You can use credit card’s high balance notification or alert features to prevent adding new charges because that will increase the utilization ratio. Another way to improve it is by asking for a limit increase to help you deal with the percentage efficiently.

Credit card companies will allow you to request additional limits through an online application, but you should update your overall income. It is possible to reach the higher limit in minutes by calling them over the phone, which is another crucial consideration. That way, you can prevent high interest rates that will affect your current financial situation.