Average Collection Period for Accounts Receivable and Its Importance

The median collection period is the length of phase it takes for a company to get payments from its customers. The typical date for collation is used by businesses to ensure that they have sufficient cash to cover their debts.

For businesses that depend significantly on days sales in accounts receivables for their financial flows. The days’ sales in AR duration is a crucial number. This shows how well a company manages its financial statement receivable.

How do Your Average Collection Periods for Accounts Receivable Work?

Money that organizations owe a business when they buy goods and/or services is referred to as AR in the business world. These trades are typically made by businesses to their clients on loan. Go to the Average Collection Period for Accounts Receivable to learn more.

AR is a measure of a company’s liquidity that is shown on its balance sheet as current assets. As a result, they show that they can settle their short-term loans without using extra cash flows.

The middling number of cycles that pass between a loan sale and the buyer’s payment date is known as the cycles trade in AR years in accounting. This is a good indicator of how well its AR management procedures are working. To run efficiently, businesses need to be able to control their middling DSO years.

In general, a shorter run-of-the-mill collecting time is preferable to a longer one. An organization that has a brief mean collation date is more likely to collect money more quickly.

This might indicate that the firm’s loan terms are excessively stringent, though. Consumers may decide to look for suppliers with more accommodating payment terms. If they don’t like the terms offered by their creditors.

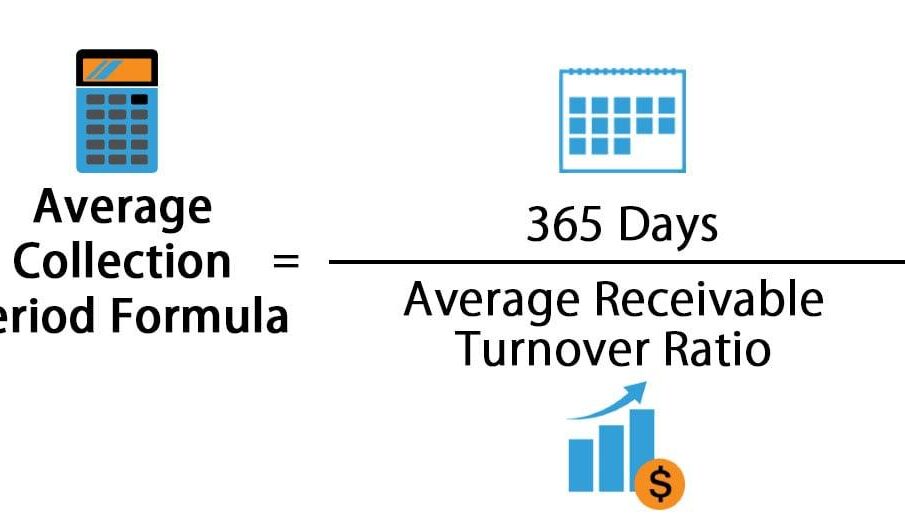

An Overview of the Formula for Average Collection Period

The quotient is then multiplied by 365 cycles after a company’s median AR balance is divided by its net credit trades during a certain time.

= 365 Days * (Average Accounts Receivables / Net Credit Sales)

The number of eras in a time frame divided by the percentage of receivables turnover. It is another, and more often used, way to represent the DSO duration. A day sales receivable ratio – check out https://www.finstanon.com/ratios-dictionary/76-accounts-receivable-turnover-days, is another name for the following calculation.

= 365 Days / Receivables Turnover Ratio

Significance of Average Collection Period to Your Business

The DSO duration can be reduced to a single figure. Yet it conveys a wide range of significant information and serves several purposes.

- It indicates the effectiveness of debt collation.

Be aware that this is substantial due to a credit sale cannot be considered finalized. Until the business has received payment. A business cannot fully benefit from a deal until money has been collected.

- Also, it demonstrates how stringent the credit terms are to your customers.

This is crucial because tight credit terms might turn off customers. While too-loose credit terms can draw in those who want to utilize the advantage of flexible payment schedules.

- It displays the performance of rivals.

That is important since public corporations have access to all the data required to determine the median collecting duration. This provides a more in-depth understanding of what other businesses are accomplishing. As well as how one’s activities stack up against others.

- This provides early warning signs of poor allowances.

Know that this is significant since more clients are delaying payments as the typical collection period rises. To make sure clients are being tracked and contacted.

Management may utilize this measure to alert them to check its outstanding receivables. Especially the ones that are in danger of being uncollected.

- It provides information on a company’s immediate financial situation.

This is crucial because a business will become bankrupt – find out more about bankruptcy. Also, it could run out of funds or resources to cover its immediate expenses.

Average Collection Period: How to Use It

As a stand-alone statistic, the median days sales in AR are not very useful. Rather, you may use it as a comparison tool to maximize its worth. This is something worth considering when you are in the trading industry.

A corporation may gain the most by regularly figuring out its median days’ sales in AR dated as well as utilizing it to look for patterns in its operations over time. Comparing one business to its rivals, either separately or collectively. This may also be done using the middling cycles of sales in accounts receivable time.

Since comparable businesses ought to generate comparable financial data. The median cycle sales in accounts receivable time might serve as a yardstick for evaluating the performance of other businesses.

Various industries might also contrast the average time to collect with the terms of credit given to clients. For instance, if bills are sent with a net 30 due date. It means that a middling collation delay of 25 days isn’t as problematic. However, the organization’s cash flows are immediately impacted by a continuous assessment of the outstanding collecting time.